June update – FTSE off record highs but the strongest quarter for over 3 years

In June, The IFSL RC Brown UK Primary Opportunities Fund returned 0.68% compared with -0.21% for the FTSE All Share.

Another busy month for primary opportunities saw us participate in a number of attractive opportunities. We participated in primary placings in The Gym Group and Alliance Pharma and secondary placings in Standard Life Aberdeen, RBS, Hargreaves Lansdown and Motorpoint. We participated in the successful IPO’s of Quilter, Knights Group and Amigo Holdings.

Markets were relatively stable for the first half of the month as markets took comfort from the historic meeting between leaders Trump and Kim and the European Central Bank’s announcement that it will end its QE bond buying by year end. This gave the market confidence of a stronger European economy. Volatility however returned towards month end on investor concerns over a US-China trade war as President Trump announced a further $200bn of tariffs on Chinese goods.

The IPO market has been strong in recent months following a slow start to the year. We are aware of a strong pipeline for the remainder of the year.

Purchases

Royal Bank of Scotland

One of the UK’s largest banks that has had a troubled decade. We purchased the shares as part of a sale of government stock which sold 7.7% of the Company, albeit is still the majority shareholder. With the shares trading at below book value and we believe its major issues behind it along with the expectation of a return to the dividend list, we considered the 3.5% discount the shares being offered at as an attractive entry point.

Standard Life Aberdeen

One of the UK’s market’s largest asset managers that was formed following the merger of Standard Life and Aberdeen last year. The merger combines a strong UK and Europe manager with the emerging market specialism that Aberdeen was known for. With cost savings to be gained from synergies and an attractive dividend yield of over 6%, we considered the placing of Lloyds’s bank remaining holding as an attractive entry point.

The Gym Group

We have held this low cost gym operator since IPO in 2015 and added to the holding following a placing to raise money for the acquisition of 13 gyms from Easygym which is earnings enhancing for the Company.

Alliance Pharma

An acquisitive pharmaceutical Company known for breathing new life into products that were considered non core by the previous owner. The shares were acquired as part of a placing to fund the acquisition of a specialist shampoo brand – Nizoral.

Hargreaves Lansdown

We increased our exposure to this market leading investment services business following the sale of some of the founder – Stephen Lansdown’s stock, at a 3.5% discount.

Quilter

Quilter is a leading private wealth and investment planning Company. The shares were acquired at IPO where the shares were demerged from parent Company Old Mutual. We consider the 25% valuation discount to peers Brewin Dolphin and Rathbones as attractive.

Knights Group

Following last month’s successful IPO of Rosenblatt, we have added another law firm to the portfolio. A strong regional firm offering a full suite of legal services. We purchased the shares at IPO and they have already risen 20%.

Motorpoint

A leading retailer of nearly new cars. We acquired the shares as part of a placing of director stock at a compelling 13% discount.

Amigo Holdings

Amigo Loans is the leading guarantor loan Company whereby individuals, with incomplete or poorer credit histories, seeking shorter term loans are able to obtain lending with the assistance of friends and family acting as guarantor. The shares were acquired at IPO and offer strong growth prospects.

Sales

Contour Global

We sold our modest holding in this owner of energy producing assets. The share price performance has been unexciting since IPO last year and whilst the shares offer some value, we saw more compelling opportunities elsewhere.

Primary Health Properties

We sold our remaining holding for a profit following strength in an otherwise volatile market. With the shares now trading at a premium to asset value, we felt there better value elsewhere.

Blue Prism

We reduced the holding in one of our largest active holdings following a 20% rise inside of a month. A market leader in Artificial Intelligence, the shares remain exciting albeit highly valued. We considered it prudent to lock in some profits.

Palace Capital

The holding was sold following the announcement of its inclusion in the FTSE All Share which saw index buying pushing the shares higher. We used this liquidity and price rise to take profits.

BT

The shares have performed poorly since purchase a year ago with ongoing concerns about its ability to continue paying its current dividend in the long term. Whilst the Company has assured the market for the next two years over its payout, we decided to cut our losses and wait on the sidelines awaiting further developments.

Sanne

A business and fund administration outsourcing group and a strong long term performer though has stalled year to date. We used a price rally in an otherwise volatile market to reduce our holding though do see some further upside in the Company if markets move higher.

Fever-Tree

A premium tonic water producer and the undoubted star of our portfolio. We took the opportunity to again reduce our holding as the stock hit fresh highs of over £34, having first purchased at IPO in 2014 at £1.34. The market is excited by the Company’s US prospects and whilst we agree there is potential significant upside, the shares in the short term appear overbought.

Sumo Digital

We reduced our holding following a good trading update by this computer games developer that was well received by the market. The shares have appreciated by 80% since purchase at IPO in December 2017.

Ten Entertainment Group

We trimmed the holding in the UK’s second largest ten pin bowling operator and one of our largest active holdings on continued strength. We await their trading update later this month.

Cumulative Performance (Total Return %)– June 2018

| Fund/Benchmark Name | Year to 30/06/2018 | 3 Years to 30/06/2018 | 5 years to 30/06/2018 |

| IFSL RC Brown UK Primary Opportunities P Acc | 8.63 | 43.96 | 69.29 |

| IA UK All Companies | 9.07 | 28.16 | 56.36 |

| FTSE All Share | 9.02 | 31.62 | 52.76 |

Discrete Annual Performance (Total Return %)– June 2018

| Fund/Benchmark Name | 30/06/2017 to 30/06/2018 | 30/06/2016 to 30/06/2017 | 30/06/2015 to 30/06/2016 | 30/06/2014 to 30/06/2015 | 30/06/2013 to 30/06/2014 |

| IFSL RC Brown UK Primary Opportunities P Acc | 8.63 | 33.21 | -0.52 | 4.67 | 12.35 |

| IA UK All Companies | 9.07 | 22.53 | -4.10 | 7.03 | 13.99 |

| FTSE All Share | 9.02 | 18.12 | 2.21 | 2.60 | 13.12 |

Source: FE 2018

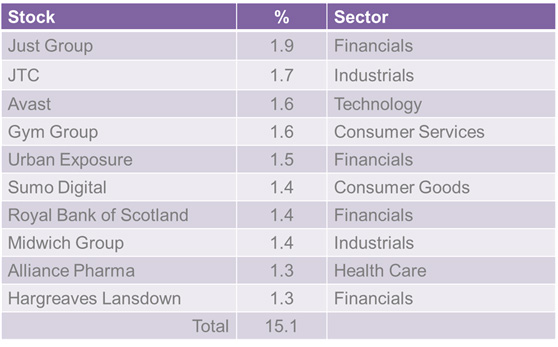

Top Ten Active Holdings

Source: RCBIM as at 30 June 2018

The past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested. R.C. Brown and Marlborough are authorised and regulated by the FCA. Marlborough Fund Manager are the ACD. The Key Investor Information Document and the Full Prospectus can be obtained via www.marlboroughfunds.com or by request at: info@rcbpo.co.uk