October update – markets suffer their worst falls of the year on trade war fears and rising US interest rates

We invested in a number of new primary opportunities during October. We are often asked what happens with primary opportunities when markets become volatile. The reality is good companies are still able to raise money in difficult market conditions and it can provide us with the opportunity to make purchases at even more attractive prices, as we will factor in market volatility to the price we are prepared to pay. The sharp market falls also gave us the opportunity to add our holdings in some of the larger FTSE constituents where we believe the falls have been overdone.

In October, the IFSL RC Brown UK Primary Opportunities Fund returned -5.91% compared with -5.19% for the FTSE All Share and -6.77% for the IA UK All Companies Sector.

A volatile month for the UK market which saw it give up all its gains for the year. A cocktail of negative sentiment saw sharp, though orderly, falls. The main culprit we consider to be US 10 year treasury yields rising to over 3%, a 7 year high. With the US raising rates to more normalised levels, investors now have an ability to obtain a reasonable return by putting money into the world’s reserve currency and hence we have seen money flow out of global equities. With the added risk of a global trade war as trade tensions between US and China remain strained, the IMF cutting its global growth forecasts and Italy’s budget deficit problems, there were many reasons for investors to shun equities this month.

The Brexit situation also remains unresolved though there are signs a deal is close. Now more than ever it is imperative to keep a well-diversified portfolio with plenty of international exposure – albeit some UK domestic names are beginning to offer compelling value, with the UK banking sector holding up well this month as all five UK listed banks reported better than anticipated results.

Purchases

Burford Capital

Burford is the global leader in finance funding to the legal sector, allowing law firms to finance and de-risk potentially costly legal cases. One of the best performing AIM-listed stocks since its IPO in 2009, we saw this as a good re-entry point into a high growth business with an excellent return on capital profile. The shares were purchased as part of a £200m placing to fund further growth.

Aston Martin Lagonda

A luxury car and goods brand. We purchased the shares at IPO with the proceeds used to pay down debt and provide capital for future models. The Company has ambitious growth plans and its first SUV vehicle in 2020 is highly anticipated. The shares have made a poor start to listed life, not aided by a sharp de-rating of growth companies taking place through out the month. We anticipate a calmer market and positive updates to produce a rebound in the share price. In our experience it is worth sitting through the inevitable ‘noise’ that comes with such a high profile IPO.

Shearwater

Shearwater is an acquisition led Company looking for opportunities in the information and cyber security sector. We were attracted to the Company by its strategy and high-quality board of directors. We acquired the shares as part of a placing of £18m to fund an acquisition that should prove transformational.

LXI REIT

LXI is a property Company seeking to deliver inflation protected income and capital growth by investing in a diversified portfolio of UK property assets. Its assets include retail, office, and both housing and affordable housing. We purchased the shares as part of a £175m raise to expand its portfolio. The shares offer stability and a solid dividend and a relative haven in volatile market conditions with the shares already showing a single digit gain set against sharp falls in the wider market.

Premier Technical Services Group

PTSG is an industrial services business offering fire solutions, access & safety, electrical services and building access. We acquired the shares as part of a fund raise to acquire an electrical testing business, an area that has seen increased scrutiny since the Grenfell Tower tragedy.

BAE Systems

A share we sold earlier in the year at significantly higher levels. With the sharp market sell off and concerns over future orders from Saudi Arabia given the recent murder of journalist Jamal Khashoggi, we viewed the sell off as overdone and an opportunity to buy in the secondary market. The shares are modestly rated with a dividend yield of over 4%.

Avast

Avast is a leading global cyber security software company. We added to our holding, first purchased at IPO earlier this year, as part of a sell down by private equity. The shares were purchased at a 6% discount to the previous night’s closing price.

International Public Partnerships

INPP is an operator of infrastructure projects across the UK, US, Canada and Australia. We acquired the shares as part of a placing to reduce debt following a recent expansion of its portfolio. The shares were acquired at a modest discount to the prevailing market price and offer stability and income.

Johnson Matthey

A chemicals and industrial business best known for its technology in catalytic converters aiding to reduce emissions and improve air quality. Like many industrial companies, the shares were sold off sharply on global growth worries. We used this opportunity to buy a high quality, FTSE 100 Company trading at lows for the year, at what we consider to be an oversold level. At the time of writing the shares had gained over 7% since purchase.

Sales

Hollywood Bowl

We sold our modest holding following a rise on a trading update for a healthy profit. We continue to hold its rival Ten Entertainment Group which trades on a discount to HB.

BBGI

We sold our largest active holding following significant outperformance in a sharply weaker market. The outperformance was beyond our expectations so we opted to take profits to re-invest in other defensive type holdings, International Public Partnership Group and LXI REIT.

Quiz

We sold our modest holding following a profit warning that brought into question the future growth of its third-party online retail sales. In our experience, it is best to cut losses sooner rather than later.

Curtis Banks

We sold our modest holding taken the opportunity of some liquidity in a stock that had held up well against our expectations in a sharply lower market.

Blue Prism

Very much a stock market darling and a strong performer for the Fund since purchase in January this year. We took the opportunity of a bounce in sentiment during the sharp sell off to exit our position for a healthy profit. Whilst we consider it a high-quality Company in the exciting field of artificial intelligence, we accept the valuation had become somewhat stretched and so are content to sit on the sidelines for the time being.

Cumulative Performance (Total Return %)– October 2018

| Fund/Benchmark Name | Year to 30/10/2018 | 3 Years to 30/10/2018 | 5 years to 30/10/2018 | Since Inception (28/05/1997) |

|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | 0.02 | 36.92 | 46.15 | 381.32 |

| Quartile Ranking – IA UK All Cos | 1 | 1 | 1 | 1 |

| IA UK All Companies | -3.72 | 20.08 | 28.79 | 239.90 |

| FTSE All Share | -1.47 | 25.37 | 30.46 | 254.24 |

Discrete Annual Performance (Total Return %)– October 2018

| Fund/Benchmark Name | 31/10/2017 to 31/10/2018 | 31/10/2016 to 31/10/2017 | 31/10/2015 to 31/10/2016 | 31/10/2014 to 31/10/2015 | 31/10/2013 to 31/10/2014 |

|---|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | 0.02 | 22.61 | 11.65 | 6.93 | -0.19 |

| Quartile Ranking – IA UK All Cos | 1 | 1 | 2 | 2 | 3 |

| IA UK All Companies | -3.72 | 15.64 | 7.85 | 6.86 | 0.37 |

| FTSE All Share | -1.47 | 13.39 | 12.22 | 2.99 | 1.03 |

Source: FE 2018

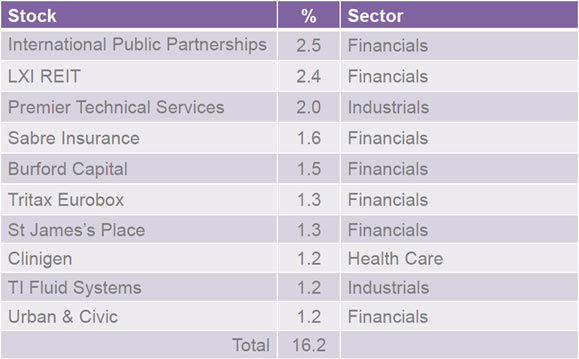

Top Ten Active Holdings

Source: RCBIM as at 31 October 2018

The past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested. R.C. Brown and Marlborough are authorised and regulated by the FCA. Marlborough Fund Manager are the ACD. The Key Investor Information Document and the Full Prospectus can be obtained via www.marlboroughfunds.com or by request at: info@rcbpo.co.uk