July update – an incredibly busy month in which we participated in a dozen primary opportunities

In July, The IFSL RC Brown UK Primary Opportunities Fund returned 1.34% compared with 1.29% for the FTSE All Share. Whilst only a modest outperformance, this was a pleasing return given the out performance of the FTSE 100 compared with the Mid and Small Cap indices, which we are invariably overweight in.

An exceptionally busy month for primary opportunities saw us participate in a number of attractive opportunities. We participated in primary placings in Phoenix Group, CentralNic, Creo Medical, Marlowe, Duke Royalty, Venture Life and DS Smith. There was a secondary placing in Urban & Civic and we participated in the successful IPO’s of Tritax Eurobox, ASA International, Nucleus Financial and TheWorks.co.uk.

Markets were relatively stable though with periods of volatility as trade war tariffs remain a concern for global markets. Chinese economic stimulus was well received, particularly by miners, aimed at boosting a slowing economy. The UK political situation remains fraught with uncertainty over whether a Conservative government can agree on a deal to present to the EU. Sterling remains under pressure which is in effect a boost to the FTSE given its overseas earnings.

We anticipate a relatively quiet August in terms of primary opportunities as is typical at this time of year. We are aware of a strong autumn pipeline as companies look to raise money for expansion that is likely to keep us busy for the remainder of the year.

Purchases

Phoenix Group

Phoenix is a consolidator of closed life assurance funds. The shares were acquired as part of a rump placing following a rights issue to help fund the £1.97bn purchase of Standard Life Assurance. The shares offer a stable income stream and dividend yield over 6%.

CentralNic

CentralNic is a domain name retailer. We purchased the shares as part of a placing to fund the acquisition of rival Keydrive, which will enhance its offering and allow it to compete its larger competitors. We consider the deal transformational and were attracted by the relatively modest valuation for a technology company.

Creo Medical

We have held this medical device Company since IPO in 2016 which has seen its shares double. We added to our holding as a result of a £48m fund raise to extend their product rollout and provide capital for potential acquisitions.

Duke Royalty

Duke Royalty provides mortgage type length loans to smaller, often family owned, businesses. We added to our holding following a placing to raise £44m which will allow the Company to expand its portfolio. The shares offer an attractive return on investment profile and a rising dividend.

Marlowe

Marlowe specialises in fire and water testing services. We added to our holding as part of a placing to fund further bolt on acquisitions as it looks to further consolidate a highly fragmented industry.

Venture Life

Venture Life is a developer and manufacturer of self-care pharmaceutical products. We acquired the shares as part of placing to repay the Company’s debt and allow funding for further acquisitions. The smallest Company by market capitalisation in our portfolio but one where we expect the valuation gap to peers to narrow as the Company grows and executes on its plans.

DS Smith

A paper and packaging Company and constituent of the FTSE 100. We acquired the shares as part of a rump placing following a £1bn rights issue to fund the acquisition of competitor Europac.

Urban & Civic

U&C is a property developer targeting larger sites in growing locations outside of London. The shares were acquired at a 7% discount following the placing of the largest shareholder’s 27% stake.

Tritax Eurobox

We have previously invested in Tritax BigBox, a UK focused property logistics Company. Tritax Eurobox aims to do the same in continental Europe as demand for larger warehouses to fulfil the growth in e-commerce become more prevalent. We purchased the shares at IPO with the Company raising an initial £300m.

ASA International

ASA is a micro finance institution providing small loans for income generating activities to low income women across Asia and Africa who cannot borrow from banks. The shares were purchased at IPO have already appreciated over 25%

Nucleus Financial

A financial adviser wrap platform which is showing strong growth in assets under direction. We acquired the shares at IPO and they have already appreciated by over 25%.

TheWorks.co.uk

A fast growing retailer, specialising in craft and hobbies, that is bucking the high street trend with over 300 stores and ambitions to open a further 50 a year. With an experienced and well regarded management, we believe the Company offers value against the backdrop of a tough UK retail environment.

Sales

With a large number of new primary opportunities, we were busy reducing or selling holdings where we felt we had achieved our expected profits, in order to recycle the money into the more attractive opportunities that we were invited to invest in. Similarly, those companies which report disappointing updates are likely to sold.

Charter Court Financial Services

This challenger bank has served us well and with the expectation of another sell-down by private equity looming, we took profits.

The Gym Group

We reduced our holding following a strong share price following the recent deal to purchase sites from EasyGym.

Mercia Technologies

An early stage investor in growth companies that has been a disappointing long term performer and struggled to close the share price gap with its NAV. We decided to cut our losses.

Restore

Following a recent trading update that hinted at toughening market conditions, we opted to sell our modest holding amid concerns that any further deterioration in trading will be punished heavily by the market in what is a relatively highly rated stock. We believe our cash better deployed in Marlowe which is a similar buy and build proposition with greater long term potential.

Just Group

We decided to dispose of our holding following a strong set of results which were not well received by the market on concerns that the Prudential Regulation Authority may change the rules relating to lifetime mortgage products that would damage its capital position. Given the uncertainty, we prefer to wait on the sidelines awaiting greater clarity.

JTC

We trimmed our holding following further strength and took some profits on a share price that has increased over 35% since IPO in March and closed the discount relative to peers.

Avast

The shares have drifted since IPO and whilst we believe the Company has a bright future, we trimmed our holding in order to fund another technology investment.

Galliford Try

We sold the remainder of our holding for a profit as we felt our cash will be better used in new primary opportunities.

Hargreaves Lansdown

The shares have continued to defy gravity and unquestionably an excellent business. Nevertheless, with shares trading at a record high and a record rating, we took the opportunity to take some profits and re-invest the cash in Nucleus Financial.

Strix

Following a strong set of results and with the shares having appreciated by more than 70% since IPO last year, we took the opportunity to trim our holding.

Eagle Eye

The smallest holding in our portfolio and following a disappointing update with sales below forecast, we opted to cut our losses to provide funds for more attractive opportunities.

Sumo Digital

Following a recent market update and with the shares having risen over 70% since IPO last year, we took some profits.

Cumulative Performance (Total Return %)– July 2018

IFSL RC Brown UK Primary Opportunities P Acc8.0944.0163.76

| Fund/Benchmark Name | Year to 31/07/2018 | 3 Years to 31/07/2018 | 5 years to 31/07/2018 |

|---|---|---|---|

| IA UK All Companies | 8.49 | 27.55 | 47.72 |

| FTSE All Share | 9.15 | 30.20 | 44.90 |

Discrete Annual Performance (Total Return %)– July 2018

| Fund/Benchmark Name | 31/07/2017 to 31/07/2018 | 31/07/2016 to 31/07/2017 | 31/07/2015 to 31/07/2016 | 31/07/2014 to 31/07/2015 | 31/07/2013 to 31/07/2014 |

|---|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | 8.09 | 27.51 | 4.49 | 5.26 | 8.03 |

| IA UK All Companies | 8.49 | 16.57 | 0.86 | 8.58 | 6.66 |

| FTSE All Share | 9.15 | 14.90 | 3.82 | 5.38 | 5.61 |

Source: FE 2018

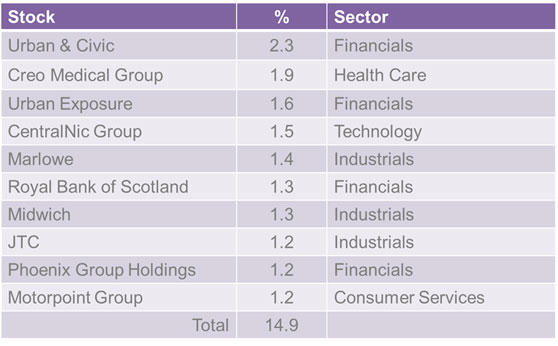

Top Ten Active Holdings

Source: RCBIM as at 31 July 2018

The past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested. R.C. Brown and Marlborough are authorised and regulated by the FCA. Marlborough Fund Manager are the ACD. The Key Investor Information Document and the Full Prospectus can be obtained via www.marlboroughfunds.com or by request at: info@rcbpo.co.uk