November update – markets continue to struggle to make headway amongst a difficult political backdrop. Beware the black swan.

We invested in two new holdings during the month – Angling Direct and Mears, both raising new money for expansion. Two sub underwriting opportunities arose in Restaurant Group and Grainger.

In November, the IFSL RC Brown UK Primary Opportunities Fund returned –1.67% compared with –1.64% for the FTSE All Share and -1.54% for the IA UK All Companies Sector.

Markets experienced further volatility following sharp falls in October. Weak Chinese retail data, fears of a slowing US economy, oil falling more than $20 from its recent high and the political landscape in Europe, all acted as headwinds.

The Brexit situation remains fluid – the UK and EU have reached agreement on an exit deal but whether it passes through parliament is another question. We can be certain there will be twists and turns in the process, increasing market volatility. Against this backdrop we have seen comments describing the UK market as ‘uninvestable’. We think this type of comment rather sensational as the UK is a very international market where UK exposure can be mitigated, for those that want. While we also see emerging value in UK focused companies, the political situation is clearly unhelpful. We cannot be certain what agreement will be reached and hence are content to hold a double-digit level of cash for the time being. We would envisage deploying this either when the situation becomes clearer or during the dislocation that we anticipate in the event no deal can be reached and the UK falls out of the EU. Black swans are rare, albeit one looms on the horizon.

Purchases

Angling Direct

Angling Direct is the market leader in fishing equipment in the UK with a growing number of stores and a leading online presence. We know the Company from its IPO last year. We participated in a £20m fund raise which will help roll the business out into Europe. A growth business in a niche market.

Mears

Mears is a social housing repairs, maintenance and care provider to local authorities and social landlords in the UK. The shares were acquired as part of a fund raise to purchase Mitie’s social housing unit. The outsourcing sector has come under close scrutiny this year with the collapse of Carillion and problems besieging Interserve. Whilst we acknowledge this is somewhat of a contrarian play with the sector out of favour and UK-centric stocks trading at a discount due to political uncertainty, we consider Mears to be at the top end of the quality scale in its sector and capable of improving the margins of the business it has purchased. The market was taken aback by the equity raise hence we were able to purchase the shares at a 10% discount to the previous night’s closing price.

Sub underwriting

Sub underwriting is where we agree to take a portion of shares that could may be left with the underwriter (the investment bank) following a rights issue. We only sub underwrite in companies where we would be happy to be left with underwriting stock. In reality, an underwriter is rarely left with stock as the rights are priced at such a large discount to the share price, typically >30%. In return for the risk we are taking, we are paid a sub underwriting fee which provides useful income for the Fund. Once the underwriting process has finished, and assuming we are not left with any stock (the stick), we will consider whether we wish to participate in the rump placing.

During the month we sub underwrote Restaurant Group (which is proposing to buy Wagamama in a £315m rights issue) and Grainger (which is proposing to buy the 75% of a private landlord vehicle it does not own in a £364m rights issue)

Sales

Zotefoams

We were content to take profits following a reassuring trading update in a Company that had held up well, despite the market downturn.

Clipper Logisitics

We sold our holding following a contract win that lifted the shares higher. The shares have not been a strong performer and whilst a growth Company, we felt there to be better value elsewhere.

Standard Chartered

We took the opportunity to cut our losses in what has been a disappointing performer, following a market rally. Undoubtedly a cheap bank, trading at half its asset value, but with no dividend payment forthcoming, we are content to sit on the sidelines for the time being.

Jadestone Energy

With oil prices in free fall, we took the opportunity of liquidity to crystallise a double digit gain in an oil company we had purchased earlier in the year.

Big Yellow Group

We took the opportunity of a good set of results to dispose of our holding. Whilst we continue to believe this is a good quality company, we consider better value to have emerged amongst UK domestics following the market downturn.

Johnson Matthey

Having only purchased in the secondary market last month on weakness, we took the opportunity of realising profits following a solid set of results. Whilst the stock saw modest broker upgrades of around 3%, we considered the double digit rise on the day as overdone (likely some bear closing) and were content to take profits. We will continue to monitor in the event of future share price weakness.

Cumulative Performance (Total Return %)– November 2018

| Fund/Benchmark Name | Year to 30/11/2018 | 3 Years to 30/11/2018 | 5 years to 30/11/2018 | Since Inception (28/05/1997) |

|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | -0.36 | 31.79 | 43.58 | 373.26 |

| Quartile Ranking – IA UK All Cos | 1 | 1 | 1 | 1 |

| IA UK All Companies | -4.19 | 17.29 | 27.03 | 234.94 |

| FTSE All Share | -1.46 | 22.62 | 29.22 | 248.41 |

Discrete Annual Performance (Total Return %)– November 2018

| Fund/Benchmark Name | 30/11/2017 to 30/11/2018 | 30/11/2016 to 30/11/2017 | 30/11/2015 to 30/11/2016 | 30/11/2014 to 30/11/2015 | 30/11/2013 to 30/11/2014 |

|---|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | -0.36 | 21.45 | 8.91 | 7.26 | 1.58 |

| Quartile Ranking – IA UK All Cos | 1 | 1 | 2 | 3 | 2 |

| IA UK All Companies | -4.19 | 15.13 | 6.32 | 4.87 | 3.28 |

| FTSE All Share | -1.46 | 13.35 | 9.77 | 0.64 | 4.71 |

Source: FE 2018

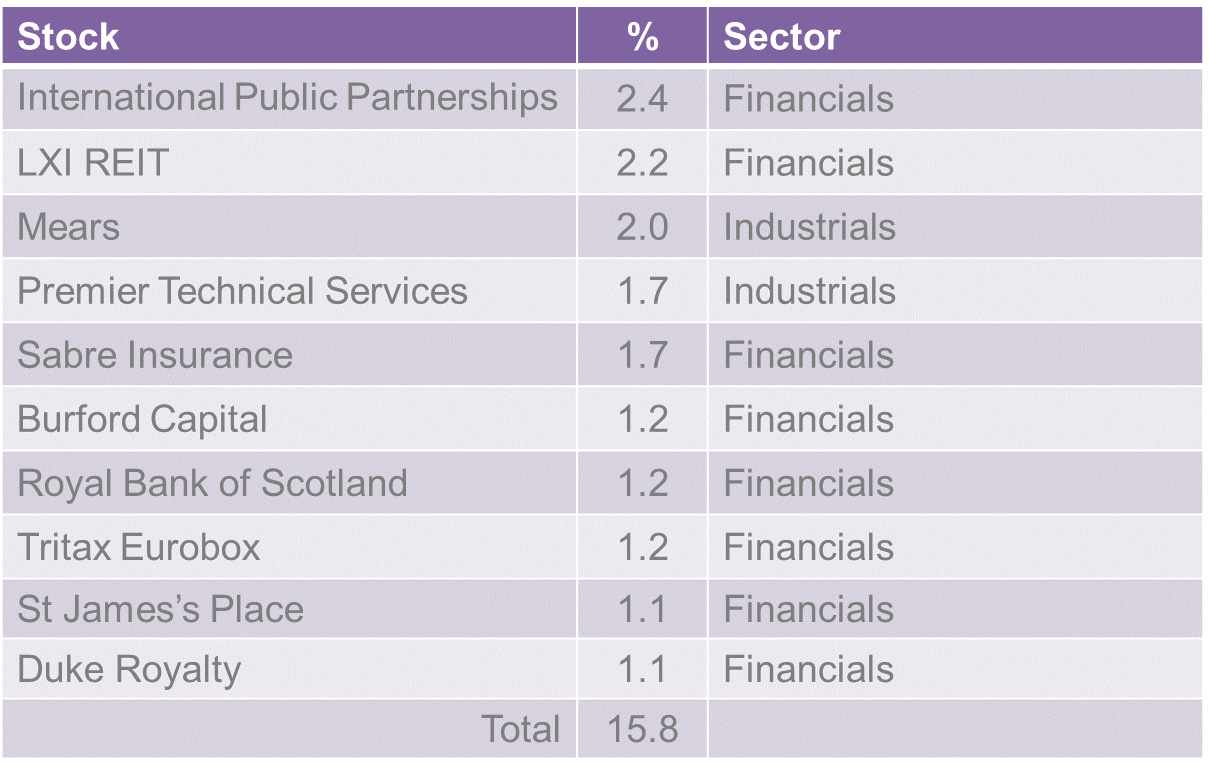

Top Ten Active Holdings

Source: RCBIM as at 30 November 2018

The past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested. R.C. Brown and Marlborough are authorised and regulated by the FCA. Marlborough Fund Manager are the ACD. The Key Investor Information Document and the Full Prospectus can be obtained via www.marlboroughfunds.com or by request at: info@rcbpo.co.uk