September update – a September surge in primary opportunities as companies seek funding to grow

A busy period for primary opportunities as we would expect at this time of year. The Fund saw strong inflows this month and we were able to deploy this in the primary opportunities that arose, as well as use market weakness to add to our holdings in the larger FTSE names.

In September, The IFSL RC Brown UK Primary Opportunities Fund returned 0.63% compared with 0.70% for the FTSE All Share.

A volatile month for the UK market which saw the FTSE hit 5 month lows before recovering its poise at month end. The FTSE has continued to lag the US market, which again hit record highs, albeit it is a narrow range of technology stocks leading that market higher. Sterling is proving increasingly volatile, and is likely to remain so, as the ebbs and flows of a Brexit deal, or even a no Brexit deal, continue to fill the headlines. We do not pretend to know what the end deal will look like, but now more than ever it is imperative to keep a well-diversified portfolio with plenty of international exposure – albeit some UK domestic names are beginning to offer compelling value.

We anticipate a busy run up to the year end and are aware of a strong autumn pipeline of corporate deals as companies look to raise money for expansion.

***Stock in focus***

Creo is a medical device company focusing on surgical endoscopy that is less invasive in the treatments of various types of cancer. The shares have risen 35% over the past month on news of its devices being used for the first time in South Africa and the extension of a distribution agreement with Pentax, a supplier of medical products and services. Whilst the investment at IPO in 2016 represented an investment in an earlier stage company than would be typical for us – we were impressed with the management team and their strategy (that they have so far delivered) and had successfully built and sold a business in the industry for £1bn a decade earlier. Whilst we have reduced our holding on occasions, the shares have trebled since IPO.

Purchases

Sabre Insurance

Sabre is a motor insurance specialist providing insurance policies typically for non-standard cases, resulting in higher margins and a best in class return on equity. We added to our holding at a 5% discount to the previous closing price, as part of a secondary sell down by private equity.

Reckitt Benckiser

A global consumer goods company and one of the larger constituents in the FTSE. Its brands include Durex, Nurofen and Vanish. We re-introduced the shares to the portfolio taking advantage of market weakness and deploying our higher than average cash levels. The shares provide stability, global exposure and a solid dividend.

TI Fluid Systems

TI is a global supplier of fuel and fluid systems to automotive manufacturers. We added to our holding as part of a placing from private equity at a 5% discount to the previous night’s closing price. We consider the shares to be modestly valued and offer a dividend yield in excess of 3%.

Big Yellow Group

Big Yellow is the UK’s largest self storage provider with over 70 sites across the country. We acquired the shares as part of a £67m placing to help fund further pipeline developments.

BBGI

BBGI is a global infrastructure fund with assets ranging from healthcare to transport. We acquired the shares as part of a £48m raise to fund future asset purchases. The shares offer low volatility with a 4.6% dividend yield and have already appreciated 5%. We expect them to soon be promoted to the FTSE 250, driving further demand for the shares.

Tarsus

Tarsus is an organiser of exhibitions and events globally, perhaps best known as the organiser of the bi-annual Dubai air show. A Company we know well from previous fund raisings – the Company raised new funds to buy out its JV business in Mexico and increase its holding in its South East Asian JV. We consider the shares to be moderately valued with a dividend yield of 4% and the added attraction of purchasing at a 9% discount to the previous night’s closing price.

Boku

Boku is a technology company that brings together merchants and mobile operators allowing customers to have purchases made via their mobile phones charged to their phone bill. We purchased the shares as part of a secondary sell down by private equity, obtaining the shares at a 12% discount to the previous night’s closing price.

DCC

DCC is a FTSE 100 Company with operations spanning 4 industries – gas, petrol retail, healthcare and technology. The shares were acquired as part of a £600m placing to raise funds for acquisition purchases.

Clinigen

Clinigen is a pharmaceutical company and provider of clinical trial services. Its clients include many of the top 50 global pharmaceutical companies. We acquired the shares, at a 10% discount to the previous night’s closing price, as part of an £80m raise to fund a major acquisition.

Funding Circle

Funding Circle is a platform linking SMEs that wish to borrow money with savers looking to obtain a better rate of return than cash. Since being founded in 2010, it has helped fill the void left by larger banks who, since the financial crisis a decade ago, have shied away from lending to smaller businesses. It is a market leader in the UK, Germany, Holland and the US but with only a small share of the business lending market and institutions increasingly using the platform to lend money, there is scope for considerable further growth. The shares were acquired at IPO.

Sales

Alliance Pharma

The shares had treaded water since purchase and following a disappointing update which saw a cut to forecasts, we acted decisively in selling our holding, limiting our losses.

Dechra Pharmaceuticals

A star of the portfolio having nearly trebled from the levels first purchased at in 2016. Following a disappointing update which saw forecasts reduced and a sharp share price fall, we no longer felt comfortable with the risk/reward level. A stock with a growth rating where growth is being called into question, is one we are content not to own until the picture becomes clearer. Despite the recent share price fall, the shares were still sold for a handsome profit.

Cumulative Performance (Total Return %)– September 2018

| Fund/Benchmark Name | Year to 30/09/2018 | 3 Years to 30/09/2018 | 5 years to 30/09/2018 | Since Inception (28/05/1997) |

|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | 7.56 | 52.41 | 64.63 | 411.57 |

| Quartile Ranking – IA UK All Cos | 1 | 1 | 1 | 1 |

| IA UK All Companies | 5.57 | 34.07 | 44.87 | 264.72 |

| FTSE All Share | 5.87 | 38.45 | 43.50 | 273.64 |

Discrete Annual Performance (Total Return %)– September 2018

| Fund/Benchmark Name | 30/09/2017 to 30/09/2018 | 30/09/2016 to 30/09/2017 | 30/09/2015 to 30/09/2016 | 30/09/2014 to 30/09/2015 | 30/09/2013 to 30/09/2014 |

|---|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | 7.56 | 22.36 | 15.81 | 1.12 | 6.82 |

| Quartile Ranking – IA UK All Cos | 1 | 1 | 2 | 2 | 2 |

| IA UK All Companies | 5.57 | 13.65 | 11.74 | 1.93 | 6.01 |

| FTSE All Share | 5.87 | 11.94 | 16.82 | -2.30 | 6.09 |

Source: FE 2018

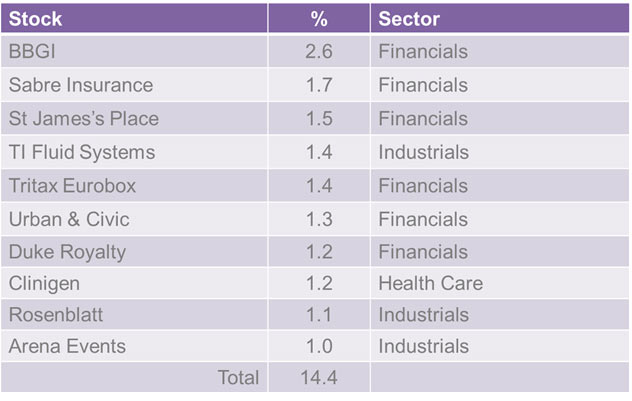

Top Ten Active Holdings

Source: RCBIM as at 30 September 2018

The past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested. R.C. Brown and Marlborough are authorised and regulated by the FCA. Marlborough Fund Manager are the ACD. The Key Investor Information Document and the Full Prospectus can be obtained via www.marlboroughfunds.com or by request at: info@rcbpo.co.uk