December update – markets end the year with a further plunge on another US rate rise and fears over future global growth. The traditional Santa rally was sadly lacking.

We participated in 5 primary opportunities in December – Grainger, Kier and Mercantile Port & Logistics, and added to our existing holdings in Marlowe and Gamma Communications. With markets volatile and declining markedly, we used the luxury of some of our cash balance to add to some of our existing holdings where we felt share prices had been overly punished.

In December, the IFSL RC Brown UK Primary Opportunities Fund returned –3.98% compared with –3.75% for the FTSE All Share and -4.67% for the IA UK All Companies Sector. (Please be advised that the past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested)

A perfect storm of concerns over the US economy, a partial shut down of the US government (due to Congress not signing off spending for President Trump’s proposed wall on the US/Mexico border) along with fears that US rates are being tightened too quickly and may choke the economy, saw markets fall sharply. Oil also fell, flirting with the $50 level, way off $80 highs just a few months earlier. Our belief is that it is not unusual for markets to have a tantrum over rising interest rates, but this in itself does not affect the ability of good quality companies to grow and create value over the longer term.

As ever the Brexit situation remains fluid – it remains doubtful that Prime Minister May’s deal will pass in its current guise but our best guess is that some kind of deal will be reached. It appears a ‘no deal’ Brexit remains unacceptable for most MP’s risk tolerances, nevertheless it remains a possibility, hence why we continue to hold higher levels of cash than normal.

2018 has unquestionably been a poor year for investors. 2019 will be challenging but we take comfort that our primary opportunities process continues to serve the Fund well as it has since inception in 1996. Stock markets are the best forecaster we know and are strongly suggesting a period of slower global economic growth. With markets having we believe largely discounted this, baring evidence of an unexpected recession, we consider the UK market to be unloved and offering value. With a UK market dividend yield in excess of 4%, regardless of the inevitable volatility, we are paid to wait and we believe greater certainty over Brexit and the health of the global economy will emerge in coming months which should provide respite for risk assets.

Purchases

Mercantile Port & Logistics

MPL is a port operator of Mumbai’s newest and third port. With a banking crisis in India making it increasingly difficult for companies to access lending, the Company instead raised £30m to continue the development of its port. With a fast-growing economy and congestion at the two other ports in the City, there is pent up demand. With the Company having experienced delays in the development of the port, with the first contracts signed and the port due to start operation, we consider this an attractive entry point, albeit, at the higher end of our risk spectrum.

Gamma Communications

Gamma is a telecoms company focused on the UK business market. We added to our holding as part of a placing by a family holding. We acquired the shares at a 7% discount to the previous night’s closing price.

Grainger

Having sub underwritten the rights issue, we participated in the rump placing following the £364m rights issue to purchase 75% of a private landlord vehicle it does not already own. With the shares trading at a material discount to NAV and a dividend yield in excess of 3%, we see this an attractive entry point.

Kier

We sub underwrote the £264m rights issue designed to reduce debt and provide greater stability for the Company in delivering and winning new contracts. The shares fell sharply on the rights issue announcement, trading below their rights price for much of the process. As a result, only 38% of shareholders took up their rights, leaving us as sub underwriters with part of the ‘stick’ at the rights price of 409p. It is extremely rare to be left with the stick but weak market sentiment and Brexit uncertainty, clearly unhelpful for a UK construction and service Company, was somewhat of a perfect storm. As is the case with any sub underwriting, the investment decision for us is whether we would be happy to receive stock at the underwriting price. We consider our entry point as highly attractive in a Company with a strong market position, with an improved balance sheet and a lowly valuation offering material upside.

Marlowe

We added to our holding as part of a placing to fund the £30m purchase of a health and safety audit consultancy business. Marlowe is continuing to consolidate this and other related safety sectors.

Sales

Sabre Insurance

We reduced our holding in this motor insurance Company as it held up well in dire market conditions. We were content to take some profits and deploy the capital where we saw greater value.

LXI REIT

We reduced our holding following marked outperformance in dire market conditions. Bought as a capital protector, we were content to take some profits and deploy the capital where we saw greater value.

Everyman Media

We took advantage of liquidity in the stock to exit our modest remaining holding and realise a profit. We remain holders of Cineworld which we consider offers greater value in the sector.

Strix

We took advantage of liquidity to exit our modest remaining holding and realise a healthy profit.

JTC

A strong performer since IPO, we used strength to take profits in a relatively highly rated Company as we see greater value elsewhere in the market post the falls.

Cumulative Performance (Total Return %)– December 2018

| Fund/Benchmark Name | Year to 30/12/2018 | 3 Years to 30/12/2018 | 5 years to 30/12/2018 | Since Inception (28/05/1997) |

|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | -7.20 | 26.27 | 35.45 | 354.41 |

| Quartile Ranking – IA UK All Cos | 1 | 1 | 1 | 1 |

| IA UK All Companies | -11.21 | 12.17 | 18.38 | 219.09 |

| FTSE All Share | -9.47 | 19.54 | 22.13 | 235.35 |

Discrete Annual Performance (Total Return %)– December 2018

| Fund/Benchmark Name | 30/12/2017 to 30/12/2018 | 30/12/2016 to 30/12/2017 | 30/12/2015 to 30/12/2016 | 30/12/2014 to 30/12/2015 | 30/12/2013 to 30/12/2014 |

|---|---|---|---|---|---|

| IFSL RC Brown UK Primary Opportunities P Acc | -7.20 | 19.36 | 13.99 | 7.61 | -0.31 |

| Quartile Ranking – IA UK All Cos | 1 | 1 | 2 | 2 | 3 |

| IA UK All Companies | -11.21 | 13.99 | 10.82 | 4.86 | 0.64 |

| FTSE All Share | -9.47 | 13.10 | 16.75 | 0.98 | 1.18 |

Source: FE 2018

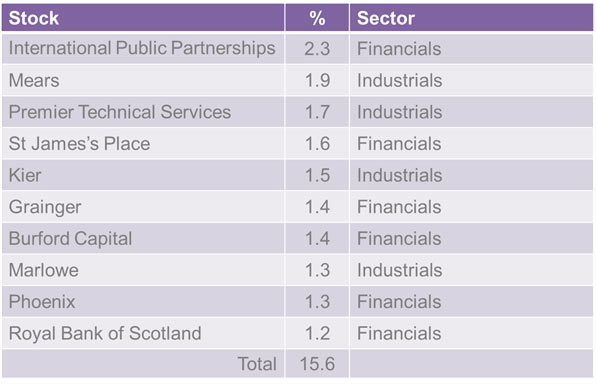

Top Ten Active Holdings

Source: RCBIM as at 30 November 2018

The past is not necessarily a guide to future performance. Investments and the income derived from them can fall as well as rise and the investor may not get back the amount originally invested. R.C. Brown and Marlborough are authorised and regulated by the FCA. Marlborough Fund Manager are the ACD. The Key Investor Information Document and the Full Prospectus can be obtained via www.marlboroughfunds.com or by request at: info@rcbpo.co.uk